Innovative Import Export Trading

Structure for SME’s – 31 March 2019

There are various trading structures available, but is your structure the right one for your business?

This innovative import export trading structure has been largely under-utilized amongst SMEs around the world that conduct international business. Ever wonder why so many large organizations set up a sourcing office in Hong Kong or other parts of Asia?

Not only is it because of its Asian office proximity to suppliers to achieve operational efficiencies, to a large extent, it is due to the fact that one may benefit from significant cost effectiveness.

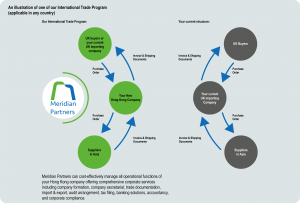

Say if you are a French SME importing consumer goods from China. By setting up a Hong Kong company, you can use the HK company to purchase goods from China and sell the same to your parent company in France or directly to customers around the world. Goods do not need to come to Hong Kong but remain to be shipped directly from China to France or wherever the customer is. The HK company will be responsible for receiving a purchase order from the parent company/customer and placing order to factories; issuing invoice; receiving payment from the customer and making payment to the vendor and so forth.

With today’s advanced technology where so many businesses are well supported by internet, a foreign business can have their own Hong Kong company without the need to hire local staff or rent a physical office in Hong Kong as all back office functions of the HK company can be fully supported by a local service provider.

So what are the merits of this kind of import export trading structure? To name a few:

- Significant cost and operational efficiencies

- Hong Kong is one of the major financial centres in the world. Highly credible legal, banking and tax systems

- The city has a very simple, flexible and easy to understand business system which is suitable for many different types of business

- No VAT ; no sales tax. Tax structure is very simple and easy to understand. Company only pays profit tax ranging from 0-16.5%

- No capital control

- Being part of China, the city serves as a springboard for foreign business planning to sell into the China market

Nowadays where even banking can go virtual, why not consider using your own Hong Kong company to conduct international business on virtual basis?